Through the UK’s OBIE we have worked with TPPs, Banks, Regulators and many others to help create the most successful Open ecosystem in the World.

Now we can bring this support to YOU!

Through the UK’s OBIE we have worked with TPPs, Banks, Regulators and many others to help create the most successful Open ecosystem in the World.

Now we can bring this support to YOU!

Now, we can bring that expertise to you, through:

See below or contact us for more information!

Launching and developing a new service is challenging – it takes courage!

Whether you are a startup Fintech with a great new idea or have been in Production for some time, our unique expertise is available to support you all the way.

We are committed to the idea of Open Banking, and therefore have a unique low cost subscription-based pricing model and beyond that you only pay for what you need. For some, we can be even more flexible – ask us for details!

We believe in long term, expert collaboration through the whole delivery lifecycle…

Andrew Bonsall, CEO Aperidata – ‘We specialise in credit risk and decisioning and our innovative software maximises the power and opportunity of Open Banking. Since joining their TPP network OB Delivery have provided invaluable assistance at all steps of the product development. The advice has enabled us to deliver our services both more quickly and at lower costs. Anthony has introduced us to potential business partners, and totally understands the value of our products and shares our views on Financial inclusion and making lending decisions better for all. The breadth of their practical expertise in the Open Banking world is unparalleled – you simply wouldn’t get this from anyone who had not been deeply involved with Open Banking since early days. For the future, we are already planning Internationalisation. We would thoroughly recommend Anthony and OB Delivery to any aspiring TPP.’

Banks face unique challenges when adapting to the requirements of the World of Open Banking. They may be subject to Regulatory requirements, with sometimes challenging deadlines. They find themselves supporting multiple external TPPs, each of whom may have their own challenges. There may be skills shortages, especially for the smaller Banks. Integrating their work with many other participants presents new challenges. Finally of course, how do you turn what may appear a threat into a transformational new opportunity?

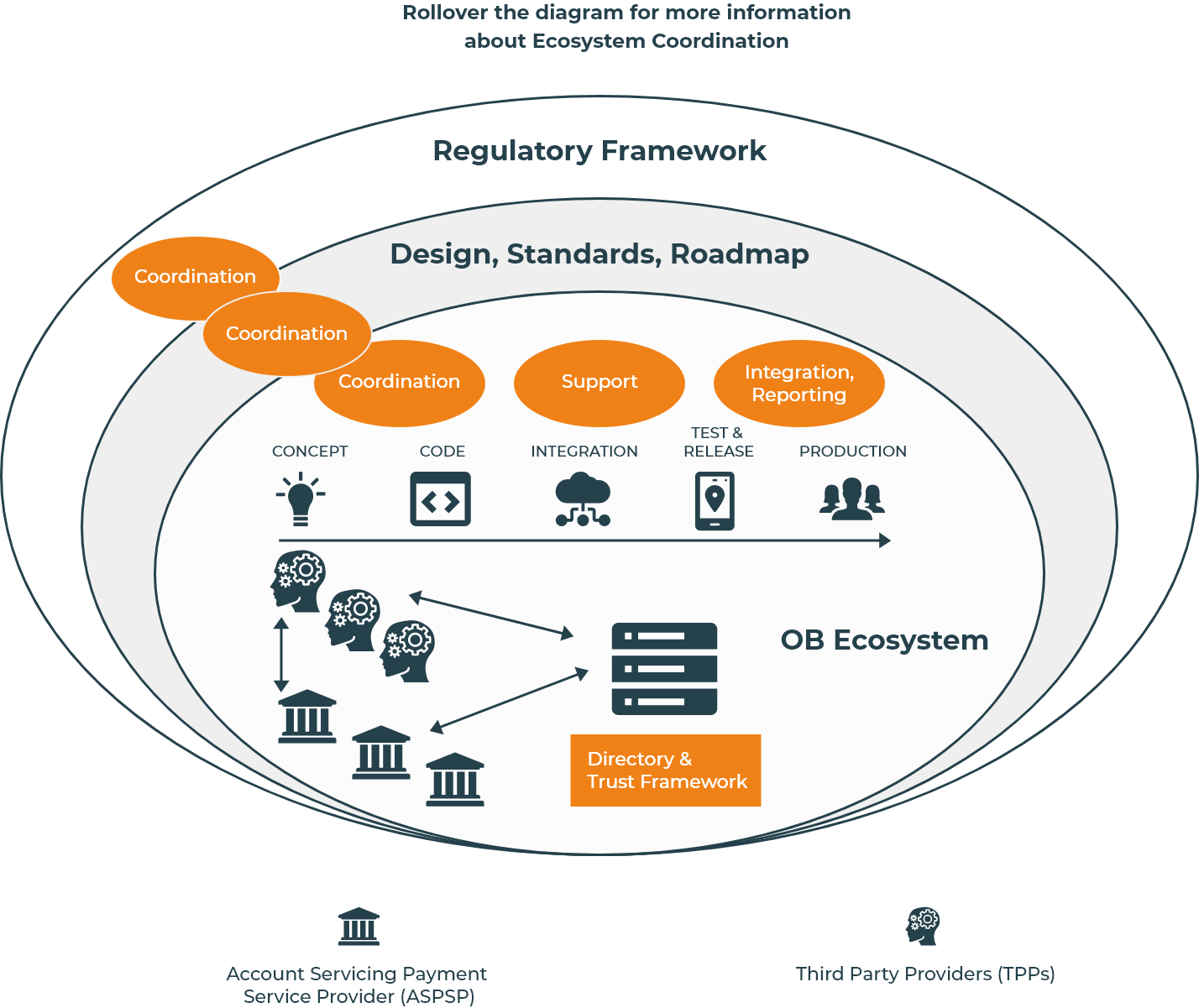

Open Banking ecosystems are complicated, and

coordination is ESSENTIAL!

Below we show how an ecosystem’s hardware and software components have to work within a much broader context in order for their potential to be achieved.

Without that, it’s simply a collection of separate bits…

The coordinating team make it work — all participants and activities other than the production and Directory & Trust Framework are impacted.

• ASPSPs – Compliance, design, roadmap, resolve issues, test advice, coordinate releases, MI

• TPPs – Onboarding, use cases, issues, testing, ecosystem status, API versions, MI

• Design, standards – Rollout planning, participant, feedback, future plans

• Regulatory – Guidance interpretation, detail ‘infill’, MI

We cannot emphasise enough – in our opinion such a role is critical. Simply because some Country OB initiatives have not planned for one does not make it optional. The most successful initiative in the World – the UK – had one and there is no guarantee the others shall succeed.

We are an independent consultancy with deep niche experience.

We can work with all partners to support the achievement of their potential.

We believe in a symbiotic relationship between our localised expertise and the broader, International, financial world.

We firmly believe that the technical components of an Open Banking (or Finance) ecosystem are now at the point of being commoditised, bringing dramatic improvements in cost and timescale for ecosystem rollout.

This also has a profound impact on HOW ecosystems can be delivered, with a far greater emphasis on what is actually required of the ecosystem – what do you want it to do?

Open Banking Delivery’s members and partners, through their extensive experience of the UK’s OBIE, provide a unique insight to the overall process of building an ecosystem – from Regulatory Standards through to Volume Production.

The combined impact of our unique experience and increasing commoditisation means that we can offer an ‘end to end’ ecosystem delivery process that is far cheaper, complete and rapid than earlier OB initiatives. It is also much more closely aligned to the original objectives.

Identifying the profile of a Country’s OB ecosystem requirements.

Ensuring those requirements are ‘mapped back’ to the original Regulatory Standards published

From the very beginning having a fully functional demonstration ecosystem acting as a ‘sandbox’ to ensure the project remains aligned and enable early identification of necessary adjustments.

Open Banking Delivery believe we have identified the principles behind the necessary requirements (e.g. low cost of participation) and underlying capabilities (e.g. ecosystem support) necessary for an effective, efficient ecosystem.

Which brings us to the question — just what does success really mean in an Open Banking ecosystem? The principles underpinning success are briefly discussed below. Please contact us if you would like to know more.

We believe there are three categories of principle, introduced below. Each can then be broken down into a series of individual principles.

These represent the ‘driver’ requirements that are used to ensure the ecosystem that evolves is the best possible, and maximises the potential.

This family of requirements need to be identified and in place before any further progress can be made. They set the scene for all that follows. The individual principles identified to date are:

• Trust

• Ease

• Support

• Cost and Funding

This family of requirements help assure that given the fundamentals are in place, the potential is determined and everything is in place to deliver on that potential.

• Engagement

• Consumer Focus

• Identify the needs

• Drive Inclusion

• Widening the horizons

• Roadmap clarity

How do you know that you have met the needs, and how well? What needs improving? What shall need to change in future to ensure service excellence is maintained?

• Success metrics

• Measuring engagement

• Assuring Ecosystem health

• Fit for growth